Understanding your Credit Report: It Makes Cents!

Many steps must be taken between the time you are thinking about buying a home and the day you move in! Plan on the process taking several months and you will not be disappointed or surprised….

STEP ONE: OBTAIN YOUR CREDIT REPORTS.

Presuming you are like most home buyers, you will need to finance your home purchase. The first step in getting the best mortgage product for your particular situation is thoroughly reviewing your credit reports from the three major credit reporting bureaus.

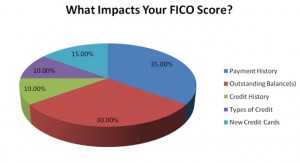

Even before you speak with a lender, you should get your FICO score (Fair Issac Corporation). In essence, FICO uses algorithms to reduce American consumers financial history to a 3-digit number somewhere between 450 and 850. The higher the number, the better your credit. The better your credit, the better your interest rate will be. To purchase your FICO score online visit www.myfico.com.

Next, obtain copies of your credit report from the 3 national consumer credit reporting companies. You are entitled to a free copy once every 12 months. By doing this step first (before applying for a home loan), you can correct any errors on your profile, establish credit (if necessary), or start repairing your credit if you’ve had problems in the past. Lenders look carefully at credit reports to ascertain your credit-worthiness and to gauge your willingness to repay the loan. Having poor credit, little or no credit, or unresolved disputes with creditors can affect your purchasing power and your ability to get a loan.

Equifax Consumer Relations

P.O. Box 105873

Atlanta, GA 30348

800-685-1111

www.equifax.com

Experian Consumer Relations

P.O. Box 2002

Allen, TX 75013

888-397-3742

www.experian.com

Trans-Union Consumer Relations

P.O. Box 1000

Chester, PA 19022

800-888-4213

www.tuc.com